Food poisoning is a common and potentially serious illness that occurs when food becomes contaminated…

Detoxify with DIY Lemon Colon Cleanse Drink 🍋

In recent years, there has been a growing trend towards natural and homemade remedies for…

Cabbage Soup Diet: A Simple, Effective Weight Loss Plan

The cabbage soup diet has been a popular fad diet for decades, promising quick weight…

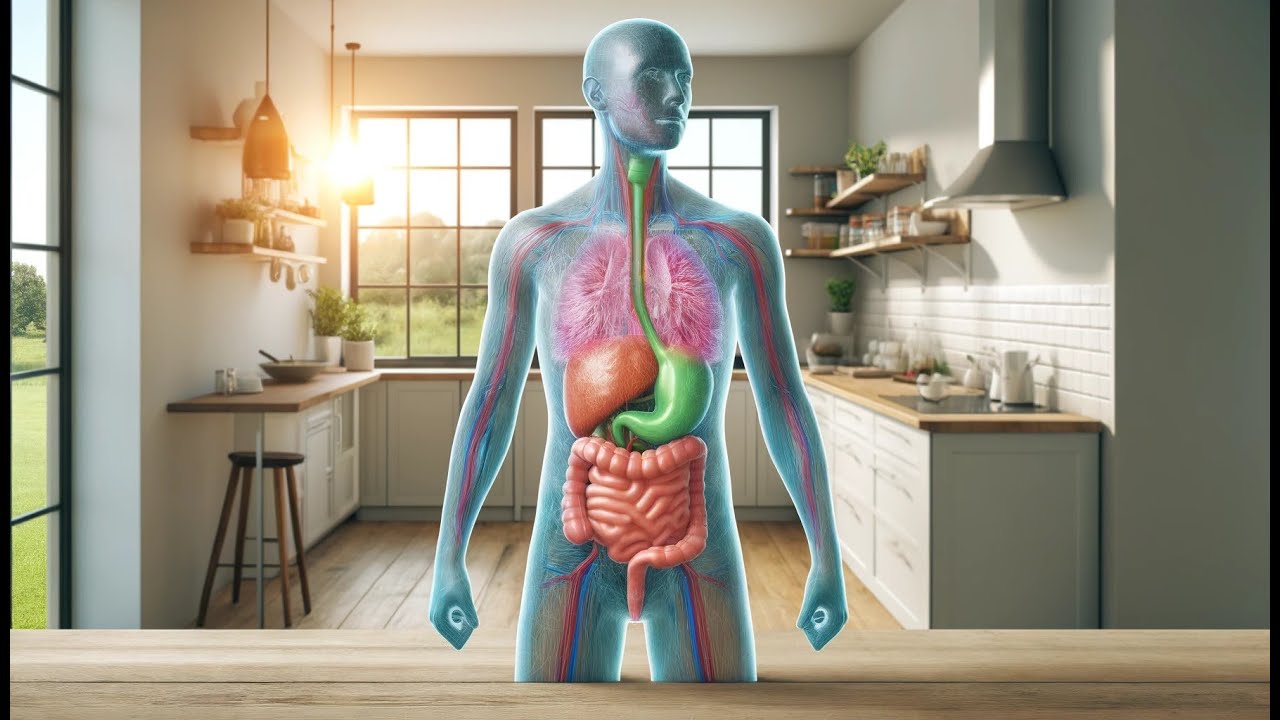

Understanding Digestion: Key Functions of Your Gut

The digestive system is a complex and intricate network of organs that work together to…

Skin Transformation After Quitting Alcohol and Smoking

Quitting alcohol and smoking can have a profound impact on your overall health, including the…

The Effects of Quitting Marijuana on Your Health

Quitting smoking weed can have a variety of effects on a person’s health and well-being….

“Smoke-Free Journey: Tools for Quitting” #health

Quitting smoking is a difficult task for many individuals, but with the right support and…

Walking vs Running for Weight Loss: Benefits of Physical Activity

When it comes to weight loss and physical activity, many people often wonder whether walking…

Maximize Muscle Growth with Essential Nutrition Tips!

Building muscle requires more than just hitting the gym regularly. Nutrition plays a crucial role…

“High Protein Transformation: Before and After Results” #health

In recent years, the high protein diet has gained popularity among fitness enthusiasts and health-conscious…